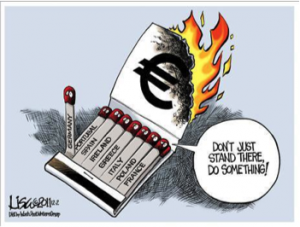

The European Central Bank took an extraordinary action: By setting the deposit rate from zero to -0.1%. Meaning that if European banks want to leave money at the ECB, they are charged a 0.1% fee. The reason is to encourage banks to lend more, and thus stimulate the EU’s slacking economy. As the EU economy for some time is in terrible form, struggling against low growth and deflation. GDP growth has stalled, recording just 0.2% in the first quarter. While, officially inflation is soft at 0.5%, heading to deflation. This measure could backfire, and not only in the EU, but in the rest of the western world too. The world may be on the brink of yet another financial crisis.

The logic behind negative interest rates is foolish. The ECB thinking is – rather than lose money by placing it on deposit with them, they believe banks will lend it out for even just a marginal return, but there are obvious flaws in this strategy. The biggest is that the central bank is essentially forcing banks to lend out money they never would have lent in the first place.

The first reason, banks h ave excess reserves because lack of qualified borrowers.

ave excess reserves because lack of qualified borrowers.

They fear people or businesses won’t be able to repay the money. So they keep that money on overnight deposit. Now the ECB charges banks a fee for keeping its money on deposit, in the expectation they will take the added risk of lending it to unqualified borrowers. But this was the origin of the last financial crisis in 2008.

In the past banks issued loans to unqualified borrowers who bought houses that they couldn’t afford. That eventually came crashing down. The same could happen in EU again.

The second potential problem: Banks could pass the added costs on to consumers, by turning their deposit rates negative. So, bank customers would get charged a fee for keeping their money on deposit at their local bank. Banks even could do this by paying no interest on deposits while also increasing customer’s accounts maintenance fee.

When this happens, depositors would pull their money out of the banking system altogether — the exact opposite of the intended effect. The banking system would then freeze up and deflation would spiral out of control as people shoved their money under their mattresses. Causing a devastating a counter  productive effect.

productive effect.

But, “The fastest and easiest way for Draghi to jumpstart Europe’s economy would be to “trash the euro” – says Shilling. When the NIRP-gamble backfires, or fails to stimulate growth. – The world economy slips back into a recession. – What options are left?

The Central Banks’ policy of freely lending out money has already caused a huge run-up in commodities, real estate, and stock valuations. As a result, these assets are already overvalued, and primed for a correction. But if the central bank or retail banks start charging depositors a fee for holding their money, investors will withdraw their savings and put that money into stocks, commodities, and real estate in search of a positive return. That would further exacerbate the bubbles already latent in our economy, making the resulting blow-up even more devastating. Instead their envisioned correction turns in another catastrophe. So the final option is returning to gold backed money at 7.000 or even higher, as Jim Rickards explained in his last book:

‘The Federal Reserve could make this price stick by conducting open market operations…” he says. ‘The purpose would not be to enrich gold holders but to reset general price levels… this kind of dollar devaluation against gold would quickly be reflected in higher dollar prices for everything else.”

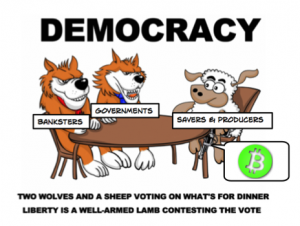

But don’t think this easily will happen. The world has never been in a position like this before – all the global currencies are fiat and dependent upon central bankers’ power. The push for a New World Order is unstoppable, – the illuminati elites are fully in control – or almost? This is why so many Precious Metals investors have miscalculated when gold and silver would take off to the upside – resulting in the collapse the fiat “dollar,” followed by most other paper currencies.

Remember these paper currencies are not actually money but commercial debt instruments, as debt cannot be money – it’s the opposite of money – a total deceit!

The Fed will do everything to prop up the dollar. Gold and Silver are the antithesis of every paper currency. Destroy these currencies, and the US; UK, EU, and Japan’s economies will collapse. Expect the elite to fight to death, and probably may come out ahead? As the illuminati elite are the owner s of the game, they don’t bother which side wins, they win anyhow.

s of the game, they don’t bother which side wins, they win anyhow.

The sanctions on Russia will wreck the EU and have little, if any, effect on Russia. Russia is already moving, with China and the BRICS, outside the dollar payments mechanism. As the demand for dollars drops, the dollar’s exchange value will drop. Initially, Washington will be able to force its vassals to support the dollar, but eventually this will become impossible.

Germany could be the breaking pivot in this game, when it turns east because of the influence of over 5.000 businesses that have interests in these markets – then the prices for precious metals will go higher.

Russia and China have become 1,000-pound gorillas on the world’s economic stage. China was betrayed by the US when they found out that all their gold entrusted to the Federal Reserve had been sold out behind their backs. The central banking elites never anticipated the total control of the world’s financial system would one day be  challenged, as it is now, by both China and Russia.

challenged, as it is now, by both China and Russia.

There is not much the US can do against China due to the high amount of Treasury bonds China owns. China could easily dump them on the world market and financially ruin the US, along with the rest of the Western world. The reason why China has not done so is because – although in the making – there is no alternative system that can readily replace the corrupt central bank control via the BIS, World Bank, and the IMF. Therefore the BRICS nations are closer to setting up their own alternative banking system, but more time is required.

Gold and silver are likely to remain locked in their protracted bottoming phase, now in its third year. When will they break free of the central banker’s manipulative shackles? It seems more lately than sooner, still. This outlook can change next week, next month, or next year.

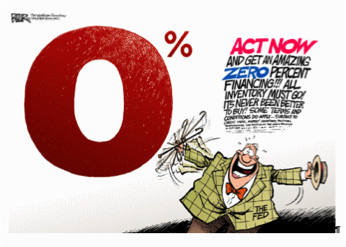

Let’s have another look at the Magic of ZIRP and NIRP – by follow the lead of Internet companies. – Invent some revolutionary type of social media exchange nobody has ever heard of. Raise $1 billion by selling bonds to the public. You have no credit and no credibility? No worries. The companies that have done best lately are those with the worst credit, according to Bloomberg. These “balance sheet bombs” have benefited most from ZIRP, NIRP, and collapsing spreads.

“Everybody wants high yield. And nobody believes the Fed will allow debtors to fail.” It continues… ”That a new company with no track record, no real product, no profits, no sales, and no business plan should have the very worst credit rating possible… and should therefore be an cinch to get plenty of credit.”

In other words, borrow at twice the going rate for IBM – let’s say 4%. With a real inflation rate of >3.91%, you’re getting money for essentially nothing. But you still have to make debt payments…

“So borrow $1 billion. You have to pay $40 million in annual interest. But you take the $1 billion and use it to buy your products (whatever they are). Your company shows sales of $1 billion. You bring about 40% of that to the bottom line… giving you debt cover of 10 times. This makes you one of the best credit risks on the market. Then, if your shares sell for 20 times earnings (modest for a tech company), the capital value of your company will soar by 20 x $400,000,000 = $8 billion!”

Started with nothing. “Through the magic of ZIRP and NIRP… along with some accounting chicanery… you now have a company worth $8 billion. Sound crazy? Yes. And that is almost exactly what the Fed is trying to encourage.”

Companies borrow. “They use the money to buy their shares. Stocks go up. This “wealth effect” is supposed to trickle down to the public, who are meant to buy the corporations’ products. Rising sales will produce higher profits. Stocks will go up. Everyone will be richer.”

The risk to the short-term investor may be that he misses out on this silly insanity. Asset prices go up; he wants to be a part of it. However the risk to the long-term investor arrives when the economy comes to its senses.

When unrest comes, there will be enough to worry about; at least you don’t want to worry about your savings. Only gold will preserve value when things turn bad, why it is recommend that every saver have at least 5% of liquid assets in physical gold or silver, preferably stored outside the country of residence.

Hoffman says, “The biggest alarm bell is the Fed. Forget what they are doing behind closed doors with the fake ‘tapering.’ When Janet Yellen is forced to come out and say we got to stop the taper, or we got to reverse it because of the failing U.S. economy, that will be the final alarm bell. After that, there will be no way shape or form that the mainstream media, Washington or Wall Street, can pretend that it is anything other than what it is–failed central bank policy.”

There is a massive deflation coming, that there will probably be an overnight devaluation of the dollar and huge overnight revaluation of gold, and, though it will be painful for most, it is the greatest opportunity in history for those who are prepared.

Keiser Report: Derp-like policy of ZIRP and NIRP

Even – Pope Francis claims global economy is close to collapse:

In an interview with Spanish newspaper La Vanguardia, he said: ‘our world cannot take it anymore. Our global economic system can’t take any more.’ – ‘We discard a whole generation to maintain an economic system that no longer endures – a system that to survive has to make war, as the big empires have always done.’ – ‘The economy is moved by the ambition of having more and, paradoxically, it feeds a throwaway culture.’ The pontiff expressed particular concern over the ‘worrisome’ statistics of youth unemployment.

He said: ”The rate of unemployment is very worrisome to me, which in some countries is over 50 percent. That is an atrocity.”

http://www.sott.net/article/280472-Pope-Francis-claims-global-economy-is-close-to-collapse

Leave a Reply